Investors Lack Stock Market Risk Perspective, as Judged by September Volatility

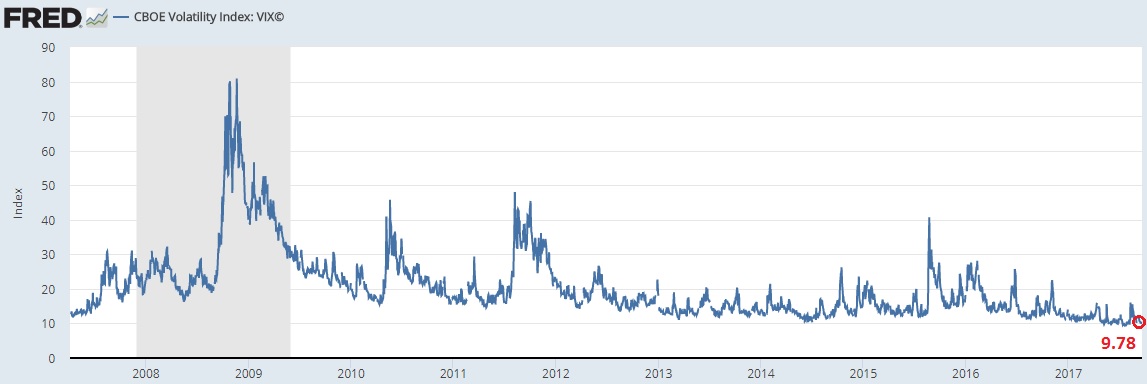

If investors are concerned about stock market risk, they’re doing a really good job of hiding it. September volatility, as judged by the VIX (aka the “Fear Index”) is on pace for its lowest reading since data was tracked in 1990. Low levels of fear often presage important market tops.

But hasn’t low volatility been ruling the day for a while? Absolutely, which is why the market’s droning melt-up has continued apace. While I’m not saying a market meltdown is imminent, the low VIX readings are puzzling.

What makes this particular situation unusual is that it’s continuing is September—traditionally the most volatile time in American stock markets. In fact, September is the only month the stock market has averaged negative returns over the last 100 years (-1.09%). That means the month of September has an average -13.08% annualized returns over that stretch. The next closest is May, with a positive 0.09% return profile. (Source: “Get ready: September is usually the worst month for stocks,” CNBC, September 4, 2017.)

Never mind the fact that several important geopolitical and economic risk events are in play.

The continuing major hostilities in North Korea; U.S./China trade war; China Bubble Fears (huge negative ramifications for U.S. economy when it pops); the Fed’s $50.0-billion balance sheet normalization plan beginning soon (a huge deal!); and more. The market has, quite literally, never climbed a wall of worry so tall. Amazing would not be a hyperbolic descriptor.

On September 20, the VIX was at 9.78, which is a far cry from the historical mean reading of just around 18. As far as we can tell, the VIX has never traded below 10 in any September since data was tracked in 1990.

(Source: “CBOE Volatility Index: VIX© (VIXCLS),” Federal Reserve Bank of St. Louis, last accessed September 25, 2017.)

A definite argument can be made that the nine-handle number looks better when gauged over the past five years. Fair enough. But the fact VIX is even seeing sub-10 handles in September really hammers home the complacency angle.

Quite literally, stock market risk is nowhere near the average investor radar. This makes the market’s one-sided trade ripe for the plucking for an ambitious seller.

What Happens Next?

If I had the definite answer, I probably wouldn’t be writing for a living. But drawing on my many years of trading and market experience, I would suggest not much… for now.

I continue to believe market collapse will only occur once recession fears grip the market. The reason is so simple, even an E-Trade baby could understand. Historically, high valuations and crashing earnings don’t mix. If there’s one takeaway from this piece, a takeaway that could save or earn you copious amounts of money, that’s it.

Looking at the evidence, it’s hard to argue that investors haven’t made the right call sticking with stocks. Central bank liquidity injections have been the titanic force holding everything together. Nothing has been able to pierce its invincibility. That’s lead to even more money chasing returns, in a self-fulfilling loop. ETF inflows are at records in 2017, and so is investor optimism. What could possibly go wrong investing under these conditions?

Everything. Why? Because similar-type conditions (investor optimism, favorable money flows) existed back in the late 1990s and mid-2000s as well. Investors have short memories. The same type of sentiment has been experienced before, and every time, it’s ended badly. The only difference is the catalyst. In this cycle, it happens to be central bank liquidity and intervention. Printing money in a powerful aphrodisiac.

Looking forward, the next big catalyst of concern is the shrinking of the Fed’s balance sheet (so-called “Quantitative Tightening” or QT). As 80% or more of the upside move has been liquidity-fueled, the downside can only come one that game goes into reverse.

At its September 20 FOMC meeting, Janet Yellen signaled that the Fed will let bonds mature and not let reinvest bond proceeds. This could pull $50.0-billion/month out of the market by 1H 2018. For my money, that will be the biggest threat to market continuity in the near term. Can the market survive on its own?

The Fed is banking on the fact it can. It believes strong employment and consumer demand are sufficient to sustain the economy; and by extension, the stock market. Whether that’s true enough this late in the business cycle is debatable. But the real acid test is swiftly approaching.

Invest accordingly.